Let’s be honest. The creator economy is a wild ride. One month you’re riding high on a viral hit, the next you’re staring at a silent phone and an empty analytics dashboard. That volatility? It’s the single biggest reason your personal finance strategy can’t look like your friend’s with the steady 9-to-5.

It’s not just about making money. It’s about building a financial foundation so your creativity isn’t constantly held hostage by the next algorithm change. Here’s the deal: we’re going to talk about money in a way that actually makes sense for the hustle, the side-gigs, and the dream of going full-time.

The Creator’s Financial Mindset: It’s a Business, Not Just a Hobby

First things first. That Instagram account, your YouTube channel, the Substack newsletter? It’s a business. The moment you earn your first dollar—whether from a brand deal, a fan’s tip, or an affiliate link—you’ve graduated. Thinking like a business owner changes everything.

It means you separate you from the venture. Your personal checking account shouldn’t be swallowing up ad revenue. It means you track your income and expenses, not just for taxes (though, wow, is that important), but to see what’s actually profitable. Is that new piece of gear really driving more revenue, or was it just a shiny object?

Your First Three Financial To-Dos

- Open a Separate Business Bank Account. Seriously, do this next. It creates a clean financial boundary and makes tracking a million times easier.

- Automate Your Tax Savings. A good rule of thumb? Set aside 25-30% of every single payment you receive. Move it to a separate savings account immediately. Think of it as money that’s already spent—by the IRS.

- Get a Simple System. Use a spreadsheet, an app like QuickBooks Self-Employed, or even just a dedicated notebook. Log every business-related expense: that portion of your wifi bill, software subscriptions, a backdrop, a new microphone.

Diversifying Your Income: Don’t Put All Your Eggs in One Platform Basket

You know this, but it bears repeating: platform dependency is risky. An income stream built solely on YouTube ad revenue or TikTok’s Creator Fund is, frankly, built on sand. The goal is to build a portfolio of revenue streams—some active, some passive—that can weather any single storm.

| Income Stream Type | Examples | Volatility Level |

| Active Income | Brand sponsorships, custom commissions, freelance services, coaching calls. | High. Requires constant pitching and work. |

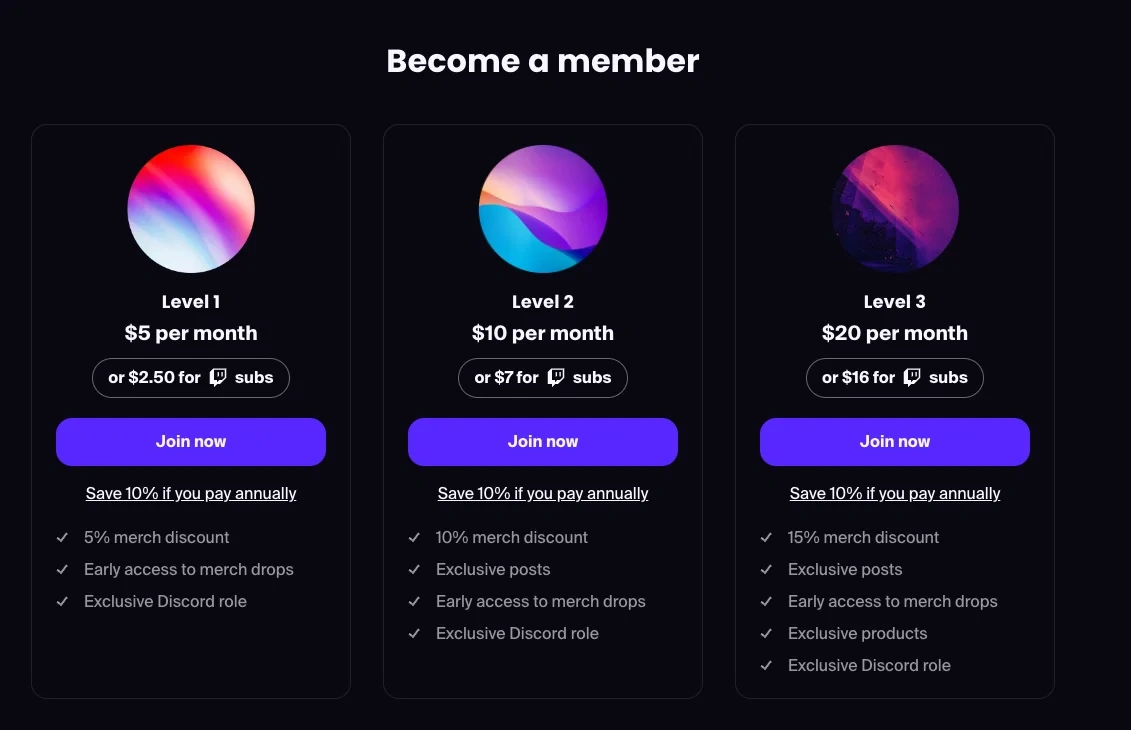

| Passive & Recurring | Digital products (ebooks, presets), online courses, affiliate marketing, membership communities (Patreon, Substack). | Medium-Low. Builds over time; provides a “floor.” |

| Platform-Based | Ad revenue (YouTube, TikTok), platform bonuses/funds, fan subscriptions (via platform). | Very High. Subject to algorithm and policy changes. |

The most resilient creators I see? They use platform-based income to fuel the growth of their own owned assets—their email list, their website, their community off the big social platforms. That’s where the real stability begins.

Budgeting When Your Income Isn’t Predictable

This is the heart of personal finance for creators. You can’t budget the same way someone with a salary does. The “50/30/20” rule often falls apart when your income looks like a mountain range.

Try the “Income Bucket” system instead.

- Calculate Your Baseline. What’s the absolute minimum you need each month to cover essentials? Rent, groceries, utilities, insurance. This is your “Must-Pay” number.

- Pay Yourself a “Salary.” In good months, transfer only your baseline “Must-Pay” amount from your business account to your personal account. Live on that. It’s tough, but it’s key.

- Create Buckets for the Rest. The surplus stays in the business account and gets divided:

- Tax Bucket: That 25-30% we talked about.

- Reinvestment Bucket: For new equipment, courses, or hiring an editor.

- Emergency Fund Bucket: This is your business’s safety net. Aim for 3-6 months of your “Must-Pay” expenses.

- Profit / Pay-Yourself-More Bucket: Once the other buckets are fed, this is for bonuses, vacations, or investments.

The Emergency Fund is Non-Negotiable

For a creator, an emergency fund isn’t just for a broken laptop. It’s for the dry spells. The months when brand deals fall through or a platform update tanks your views. This fund buys you the mental space to create strategically instead of panicking and taking any low-ball offer that comes your way.

Planning for a Future You Can’t See: Retirement and Insurance

Yeah, it’s not sexy. But thinking long-term is the ultimate power move. When you’re self-employed, no one is setting up a 401(k) match for you. The onus is on you.

Look into a Solo 401(k) or a SEP IRA. You can contribute a significant amount, and it lowers your taxable income now. Start small. Even 1% of your irregular income, automated into one of these accounts, is a start. It’s about building the habit.

And insurance? Health insurance is a major pain point, I know. But also consider disability insurance. If you get injured and can’t create—what happens? It’s a grim thought, but protecting your income-generating ability is a core part of personal finance for the self-employed.

The Mental Game: Money and Burnout

Here’s the part we don’t talk about enough. The pressure to monetize every piece of content can suck the joy right out of creation. When your art is also your rent check, it’s heavy.

That’s why those diversified income streams and that emergency fund are so crucial. They aren’t just financial tools; they’re psychological armor. They give you the freedom to say “no” to a misaligned sponsorship. They allow you to take a week off to recharge without financial terror. They let you experiment with a new format that might fail, but could also be your next big thing.

In the end, personal finance in the creator economy isn’t about getting rich quick. It’s about building a sustainable engine. It’s about designing a financial life that supports your creative life, not the other way around. It’s the quiet, unglamorous work that happens off-camera, ensuring the show can go on—on your own terms.